Everything you need to know about Unum Long-Term Care Insurance

Note: The cost of SDPEBA’s LTC plan with Unum is expected to increase in June. We are pushing this article out because if you get a plan now, you’ll lock in the lower price. We highly recommend you consider adding this plan. Contact us for more info: 888-315-8027

Long-term care insurance is one of the rarest forms of insurance because it is rarely offered, which is frustrating when you realize that around 70% of adults age 65 or older need some form of daily assistance. Today, the average cost for an in-home health aid is $64,000 annually. Assisted Living facilities cost anywhere between $50,000-$70,000 and these are prices that are expected to increase dramatically over the next 20 years.

Having a plan in place is important to make sure these costs never blindside you or your family, and the best way to do that is to get long-term care insurance.

How does it Work

Long-term care insurance begins to provide coverage 90 days after a doctor determines that long-term care is needed. The reason there’s a 90-day waiting period is because that’s usually how long your health care will pay for care services, and also because long-term care insurance only covers long-term care.

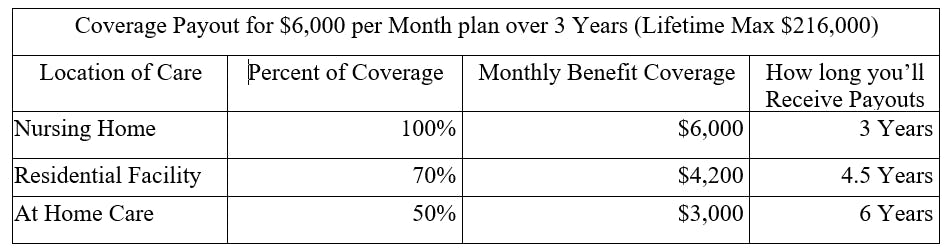

The amount of coverage you receive varies based on the plan you choose and the “benefit period.” These choices will define how long you’ll receive coverage and how much the insurance plan will cover you each month.

When you elect a coverage amount, you’ll be choosing a number between $3,000 to $8,000 to receive monthly. Depending on where you receive care (a nursing home, a residential facility, or at home) you’ll receive a different percent of your monthly coverage based on that number.

As you can see, no matter where you receive care, you’ll never get less than your lifetime maximum, but the duration in which you receive payouts will vary. So, you’re never leaving money on the table, you’re just going to have a different allowance for different times based on where you choose to receive care.

This can also change. If you start off at a nursing home and then move to at home care, the benefit period and monthly benefit coverage will be adjusted to reflect that.

Who should get this Plan?

Because this plan is so customizable and adjusts based on your age and health, it should be considered by everyone, regardless of family history. Let’s face it, right now is the youngest (and probably healthiest) you’re going to be, meaning right now is the best time to enroll in something that bases its price on how young you are!

Additionally, if you have a family history of Alzheimer’s or other genetic diseases that require long-term care, then you should consider signing up for this insurance. It’s the safest way to ensure you’ll be able to get the care you deserve without becoming a financial burden.

Check out this article for more information on budgeting long-term care into your retirement plan.

What’s Covered?

Unum’s long-term care insurance pays you directly once you qualify to start receiving payouts for your insurance. To put it plainly, once you meet Unum’s qualifications and have a doctor sign off on them, you’ll stop paying your premium and begin receiving your coverage.

For more information on what’s covered, you can check out the schedule of benefits by clicking here or Unum’s outline of coverage linked here.

How much is it?

Since there are a lot of options and types of coverage, your price my vary. For a rough estimate, it’s best to just run through some hypotheticals.

If a 50-year-old is seeking insurance, they start by deciding how much monthly benefit coverage they want and if they want inflation coverage. For this example, let’s say they choose the $5,000 monthly benefit plan with inflation coverage. They would end up paying $67 per pay period and would end up with over $60,000 of coverage per year (that will increase by 5% each year)[WS1] should they come to need long term care.

These figures are from Unum's premium calculator. Check it out and see what plan would work best for your budget or click the link below to schedule a call with our long-term care specialist.

Click here to Schedule a Long-Term Care Call

How do you use it?

Once you are qualified to enter into a long-term care facility or start requiring long-term care services, you’ll begin your 90-day elimination period. Once that’s finished, you’ll stop paying your premium and begin receiving payouts.

Proving you can receive your long-term care insurance is also on your doctor, not you or your insurance. So, if your doctor says you need it, you’ll get it. Once you’re enrolled in a long-term care service you can contact 800-227-4165 and begin the benefit process.

This is also an “indemnity plan,” meaning you’ll receive the full payout regardless of the price of care you receive. That means, if you’re in a nursing home that costs $5,000, but you have the $6,000 plan, you’ll still receive the $6,000.

How do you Enroll?

The best path to enrolling is to go through our Unum specialist. Email [email protected] or sign up for a meeting by clicking here and he’ll walk you through your options, talk you through the rate calculator, and help you make the best choice.

Want to Learn more?

Check out these articles for more information!

The Importance of Long-Term Care Insurance

5 Reasons to Sign up for Long-Term Care Insurance

Long-Term Care: How do I pay for it? How Much is it?